By Patricia Cohen, The New York Times, March 14, 2015

“Get your billions back, America,” the tax preparer H&R Block urges in television advertisements.

What many taxpayers may not realize is that they already do. When it comes to the government, taxing is often just another name for spending.

There are tax credits and tax deductions; tax exclusions and tax exemptions; tax deferrals and tax reductions; tax discharges and tax preferences, all of which put money in people’s wallets rather than take it out.

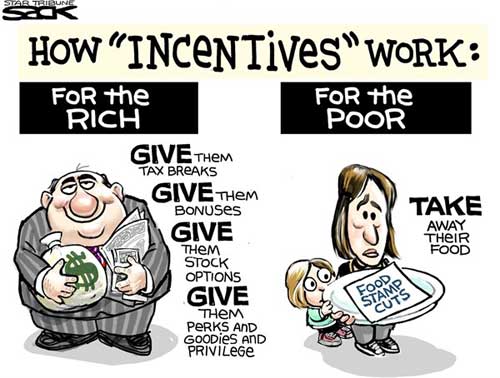

There is one critical difference between tax-related payouts, however, and those that come directly from the federal budget: Spending channeled through the tax code tends to overwhelmingly benefit the wealthiest Americans.

According to an analysis of $340 billion in tax subsidies for housing, education, retirement and savings in 2013, the top 1 percent received about $95 billion, more than the $90 billion received by the bottom 80 percent combined, said the Corporation for Enterprise Development, a nonprofit organization that seeks to build assets for low- and moderate-income families.

“Every year, the federal government spends billions of dollars on these tax programs primarily to support the highest-income households that need support the least,” said Ezra Levin, associate director of government affairs for the group, which is based in Washington.

Relentless pressure in recent years, particularly by conservatives, to reduce program spending has meant that the tax code has increasingly become the primary driver of social policy when it comes to education, retirement and housing.

The amount of spending in those areas channeled through taxes is on the rise, topping $620 billion in 2014, up from $540 billion in 2013, according to Mr. Levin’s analysis. By comparison, federal discretionary spending by 14 of the 15 cabinet agencies, including housing, transportation, labor, commerce, education, Treasury and health and human services totaled $464 billion.

“This is not a liberal position or a conservative position,” he said.

No comments:

Post a Comment